Free cash flow FCF is the cash flow to the firm or equity after all the debt and other obligations are paid off. To calculate free cash flow all you need to do is turn to a companys financial statements such as the statement of cash flows and use the following FCF formula.

Free Cash Flow Formula Top 3 Fcff Formula You Must Know Youtube

This excess free cash flow can be used to give investors a return or invest back into the business.

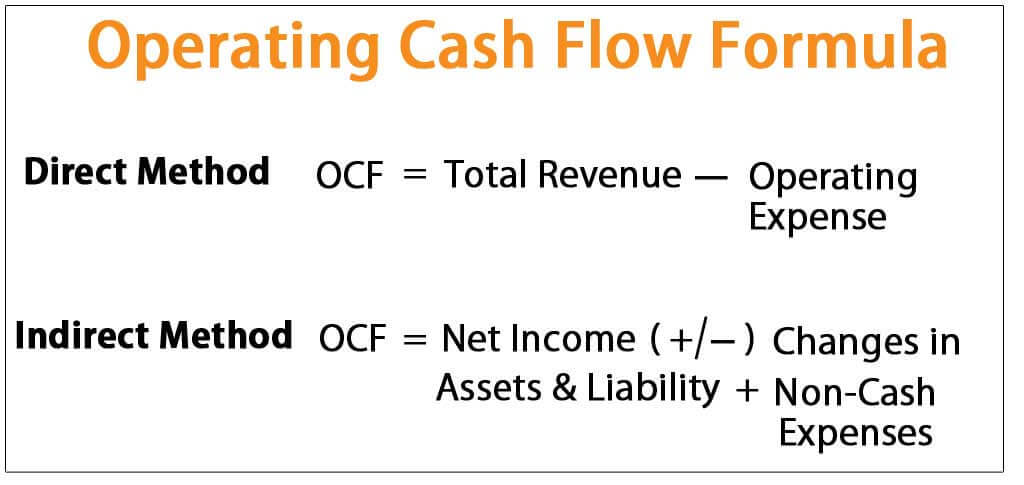

Free cash flow equation. FCFF CFO IE 1 TR CAPEX where. The free cash flow formula is. FCF reconciles net income by adjusting for non-cash expenses.

Meaning of FCF Explained in Detail. Free cash flow or FCF can be described as a firms cash flow or equity post the payment of all debt and related financial obligations. Free Cash Flow Net Operating Profit After Taxes Net Investment in Operating Capital where.

The formula below is a simple and the most commonly used formula for levered free cash flow. In other words free cash flow can be defined as the money made by a company through its operations minus expenditures on assets. Net Operating Profit After Taxes Operating Income 1 - Tax Rate and where.

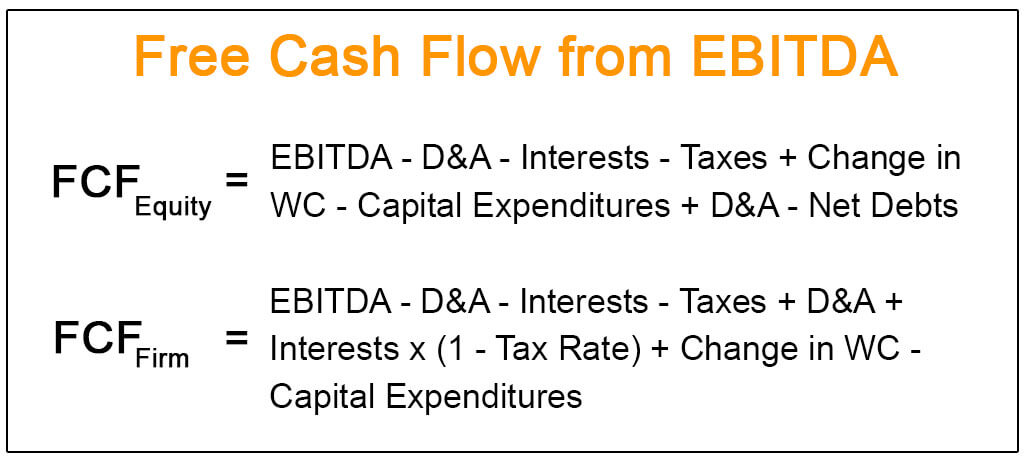

A common measure is to take the earnings before interest and taxes multiplied by 1 tax rate add depreciation and amortization and then subtract changes in working capital and capital expenditure. Free Cash Flow Formula helps a company to make a decision of new product debt business opportunity. There are multiple uses of the free cash flow equation they are as follows- To calculate the profitability of a company.

Step 2 Non-Cash Expenses. It helps support the companys operations and maintain its assets. Heres how to calculate free cash flow for Tims business using the FCF formula.

Free cash flow can be calculated in various ways depending on audience and available data. To get a financial position of a company. Free Cash Flow Formula helps to.

Free cash flow FCF represents the cash available for the company to repay creditors or pay dividends and interest to investors. It serves as a measure of the cash a firm generates or is left with once the amount of required working capital and capital expenditure is accounted for. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders.

We can further break down non-cash expenses into simply the sum of all items listed on the. Free cash flow measures profitability. Free Cash Flow Operating Cash Flow CFO Capital Expenditures Most information needed to compute a companys FCF is on the cash flow statement.

Net Income Net Income is a key line item not only in the income statement. The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax rate 1-t. Free cash flow Operating cash flow - Working capital changes - Capital expenditures - Dividends The calculation of free cash flow for a nonprofit entity is somewhat different since a nonprofit does not issue dividends.

Variables of the FCFF Formula. Cash flow from operations -. It is the cash left for a company after paying for its production costs and capital expenditures.

This can also be referred to as unlevered free cash flow and it represents the surplus cash flow available to a business if it was debt-free. CFO Cash flow from operations IE Interest Expense CAPEX Capital expenditures beginaligned textFCFF textCFO textIE. Free cash flow yield is similar in nature to the earnings yield metric which is usually meant to.

If youre analyzing a company that doesnt list capital expenditures and operating cash flow there are similar equations that determine the same information such as. As you can see Tims free cash flow is greater than his capital expenditures. The simplest way to calculate free cash flow is to subtract a businesss capital expenditures from its operating cash flow.

Free cash flows refer to the cash a company generates after cash outflows. Free cash flow is usually different from net income. The ratio is calculated by taking the free cash flow per share divided by the current share price.

Thus Tim would calculate his OCF like this 100000 100000 80000 10000 5000 95000. A common starting point for calculating it is Net Operating Profit After Tax NOPAT which can be obtained by multiplying Earnings Before Interest and Taxes EBIT. As an example let Company A have 22 million dollars of cash from its business operations.

How to Derive the Free Cash Flow Formula Step 1 Cash From Operations and Net Income. It is a measure of how much cash a company generates after accounting for the required working capital and capital expenditures CAPEX of the company.

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Fcf Definition Formula And How To Calculate

Levered Free Cash Flow Calculation Wall Street Oasis