The market will set these rates on a real time basis as and when new information flows in. I Elimination of Uncertainty and Risk.

Exchange Rates Currency Systems Economics Tutor2u

Unlike fixed exchange rates based on a metallic standard floating exchange rates dont require an international manager such as the International Monetary Fund to look over current account imbalances.

Floating exchange rate system advantages and disadvantages. Floating exchange rates have these main advantages. Here we discuss floating exchange rates examples advantages and disadvantages. Advantages and disadvantages of floating exchange rates Advantages of floating exchange rates.

Freely floating exchange rate means that the market will determine the rate at which one currency can be exchanged for another. The very fact that currencies change in value from day to day introduces a large element of uncertainty into trade. One of the main disadvantages is that floating currencies can be volatile which makes doing businesses harder.

This short revision video looks at some of the key advantages and disadvantages of a country operating with a free floating exchange rate currency system. Protection from external shocks - if the exchange rate is free to float then it can change in response to external shocks like oil price rises. This should reduce the negative impact of any external shocks.

Any undue fluctuations in exchange rate cause problems to the plans and programmes of. Floating exchange rates also have disadvantages. Unlike fixed exchange rates based on.

A pegged rate or fixed exchange rate can keep a countrys exchange rate low helping with exports. Geoff Riley FRSA has been teaching Economics for over thirty years. The value of a currency against another can be severely diminished in a single trading day.

Depending on the government s specific macroeconomic objectives and how developed the economy is freely floating exchange rates can be a good option. Disadvantages of Floating Exchange Rates. If these bodies do not step in there is bound to be an economic shock to the country.

A seller may not be quite sure of how much money he will receive when he sells goods abroad. One of the main advantages of pegged exchange rates is the reduction in the volatility of the exchange rate at least in the short-run. This has been a guide to what is Floating Exchange Rate and its definition.

A country is somewhat insulated from the problems experienced in another country due to the freely floating exchange rate system. In simple terms a managed floating exchange rate is a system where currencies fluctuate daily but the regulatory authorities including the government and the Reserve bank of India may step in to control and stabilise the value of the currency. It can adversely affect a country that has high unemployment.

But due to its volatile nature investors might not want to take higher risks. Advantages Disadvantages A floating exchange rate is a regime that determines a currencys value set by the forex market based on demand and supply in relation to other currencies. The necessary condition for an orderly and steady growth of trade demands stability in exchange rate.

Now that you know the basic difference between the two heres a look at what makes a floating exchange rate good or bad. He has over twenty years experience as Head of Economics at leading schools. Advantages of a floating exchange rate.

Disadvantages of the Floating Rate Uncertainty The fact that a currency changes in value from day to day introduces instability or uncertainty into trade. Freely floating exchange rates allow the governments and central banks. Conversely pegged rates can sometimes lead to higher long-term inflation.

Of course the rate changing will affect price and thus sales. By Aristotelis Somarakis Elias Papaioannou University of Macedonia SummaryThe purpose of this article is to review the historical exchange rate regimes followed by Great Britain during the 20th century such as the fixed exchange rate regime the floating exchange rate regime and the special regimes chosen during specific periods such as World War II the Bretton. No need for international management of exchange rates.

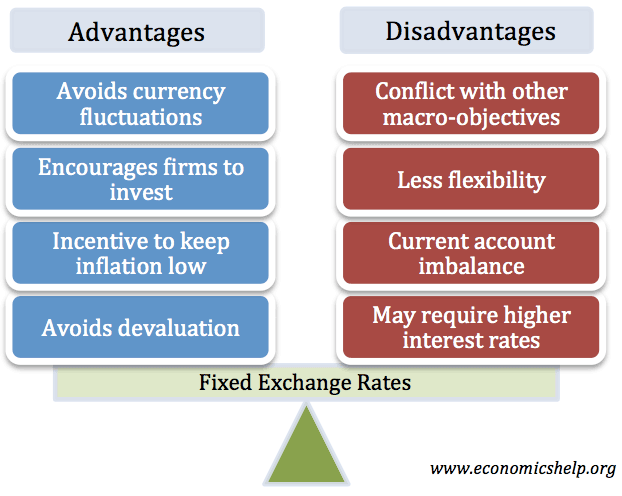

Unlike fixed exchange rates these currencies float freely unrestrained by government controls or trade limits. Let us make an in-depth study of the advantages and disadvantages of the fixed exchange rate system. Similar to fixed exchange rate the choice of the currency or basket of currencies to peg is affected by the currencies in which the countrys external debt is denominated and the principal trading partners.

Disadvantages of the Freely Floating Exchange Rate System. Sellers may be unsure of how much money they will receive when they sell abroad or what their price actually is abroad. If a currency is favorable then the floating exchange rate can be beneficial for the country.

Managed Float Exchange Rate System. A floating exchange rate is determined by the private market based on supply and demand whereas the fixed rate is decided by the central bank. Test Your Knowledge MCQ on Floating Exchange Rates - revision video.

Floating exchange rates have the following disadvantages. List of Pros of Floating Exchange Rate. An unexpected fall in the exchange rate can also be a cause of rising inflation.

Disadvantages of a floating exchange rate High level of exposure to exchange rate volatility By nature floating exchange rates are volatile and prone to sharp fluctuations.