Failure to meet the obligations of the loan may also cause the loan to become due and payable which may be seen as a con of reverse mortgages. But unlike a home equity loan or line of credit.

Ask An Attorney Should I Consider A Reverse Mortgage Las Vegas Sun Newspaper

For example a typical reverse mortgage may provide a homeowner with a 300 per month payment.

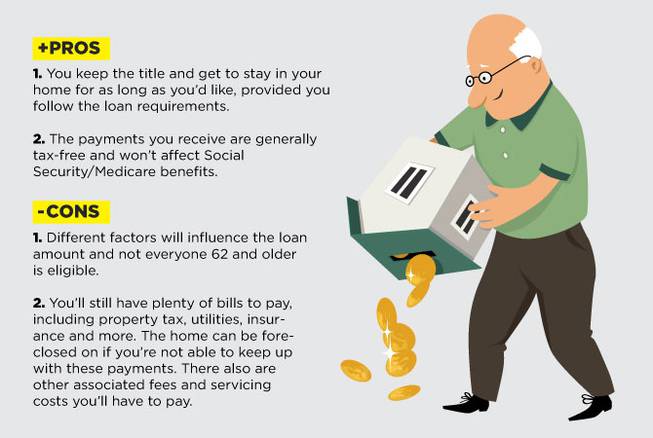

Downside of reverse mortgage. A Home Equity Conversion Reverse Mortgage HECM more commonly known as a reverse mortgage is often used as a means of income for retireesFor those age 62 or older these loans can provide. This is a particularly useful advantage if you secure a Reverse Mortgage and then home prices decline. Higher initial setup costs when compared to traditional home loans Ongoing mortgage insurance charges MIP May affect needs based programs SSI Medicaid Becomes due if you leave home permanently Less equity for heirs.

Reverse Mortgage Pros and Cons. Fees a reverse mortgage closing carries fees like any mortgage Insurance premiums FHA insurance is paid upfront and annually. Your Heirs InheritanceWhen homeowners die their spouses or their estates would customarily repay the loan.

You cant handle the costs. Timing is important when it comes to taking out a reverse mortgage. You must have at least 50 equity in your home.

Closing costs maintenance. Reverse mortgage myths and the truth Misconceptions about reverse mortgages may cause homeowners to avoid consideration of these complex loans. Your chances of outliving your reverse mortgage increase if you.

Also Reverse Mortgage Lenders have no claim on your income or other assets. Of course reverse mortgages do remain something of a gamble as during the period of the loan interest rates could go higher or lower as could the value of the home leaving you with either much. You Have Medical.

In simple terms a reverse mortgage is a mechanism for you to access the equity in your home. A reverse mortgage loan is a non-recourse loan. For many a reverse mortgage is a huge lifeline and well suited to their particular situation.

The reverse mortgage will almost always decrease the equity in your home which will leave less money to your heirs. The biggest downside of a reverse mortgage is its effect on equity. This is due to the rising-debt nature of reverse mortgages.

Projected equity over time and inheritance for heirs a reverse mortgage draws down on. Reverse mortgages can be paid out in several ways such as in a lump sum in steady payments over time or as a line of credit to draw on as you need. Generally you have the option to receive the proceeds from a reverse mortgage in monthly payments a line of credit or a lump sum.

Reverse mortgages tend to be very expensive when compared with a conventional mortgage. It may help to compare the costs of reverse mortgage. If youre looking to.

Disadvantages of Reverse Mortgages. Lets examine how reverse mortgages work while also looking at the advantages and disadvantages. If your home increases in value in the future you may consider refinancing your reverse mortgage to access even more loan proceeds.

This means that neither your nor your heirs are personally liable for any amount of the mortgage that exceeds the value of your home when the loan is repaid. Some financial planners have also used reverse mortgages to. Live a long time.

The first disadvantage is the relative cost of a reverse mortgage. However youre unlikely to earn more with an annuity than you are being charged in interest and fees on the reverse. Reverse mortgage contracts can have hidden costs such as fees and interest can eat up your home equity.

Annuities are frequently pitched to seniors along with a reverse mortgage. You Live With SomeoneIf you have friends relatives or roommates living with you who are not on the loan paperwork. With a Reverse Mortgage you will never owe more than your homes value at the time the loan is repaid even if the Reverse Mortgage lenders have paid you more money than the value of the home.

Like every form of home financing there are pros and cons to each. 5 Signs a Reverse Mortgage Is a Bad Idea 1. The interest compounds for many years and fees are charged on the proceeds all of which can quickly erode your equity.

In addition to its downsides there are three examples of when a reverse mortgage might be totally out of the question. The money from a reverse mortgage can last you a long time but it may not last forever. You want to move fairly soon.

A reverse mortgage can provide income to seniors based on the equity in their homes. The final downside to the reverse mortgage affects your estate. Downsides of Reverse Mortgage A potential drawback is that the reverse mortgage loan becomes due when the borrower sells the home moves out of the home as their primary residence or passes away.

What Is the Downside to a Reverse Mortgage.