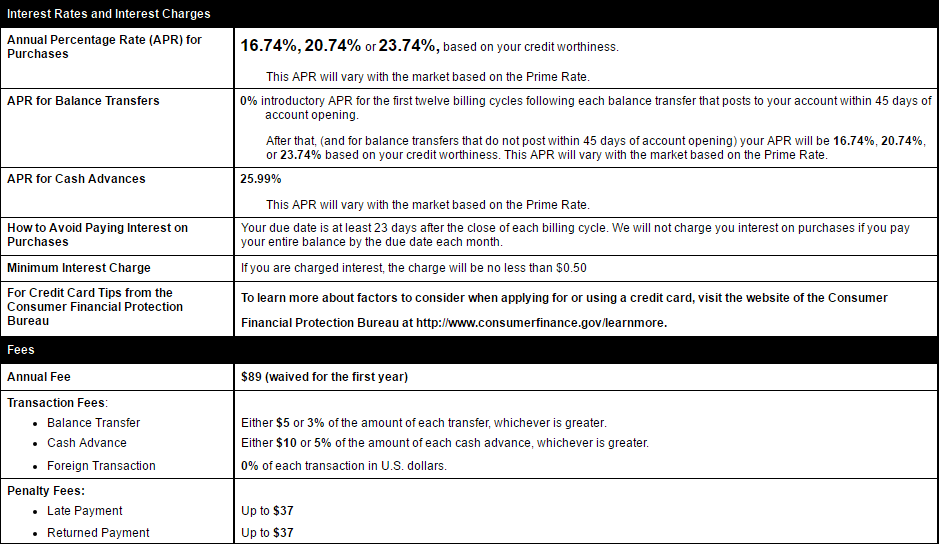

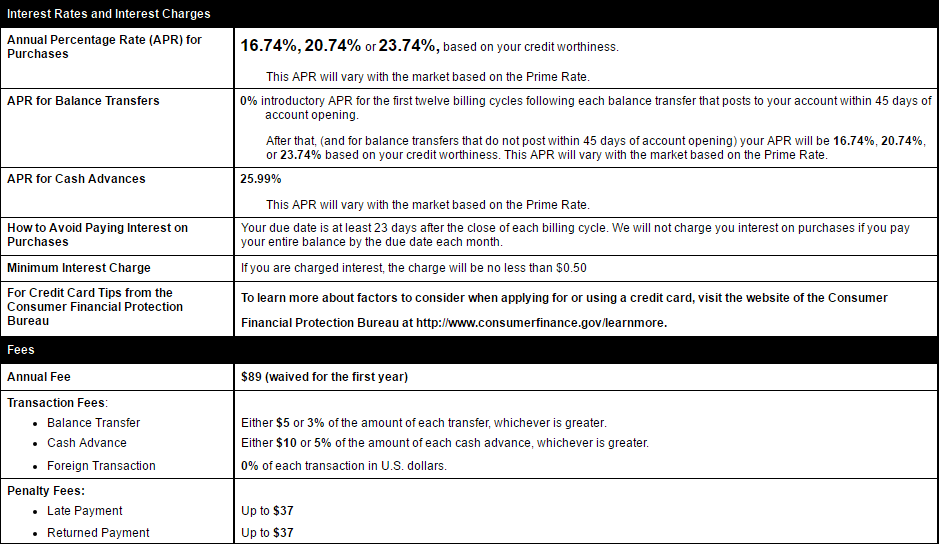

Credit cards are an important part of your business and personal financesUnderstanding how they work is vital to long-term financial success particularly if you use credit cards for everyday purchases. How its applied and how its calculated.

What Is A Good Apr For A Credit Card Experian

Your APR is shown as a percentage and includes fees and costs related to the loan.

Credit card apr for dummies. A credit card offers revolving credit which you can think of like a rechargeable battery. This is a term used in reference to ev. Welcome to my MissBeHelpful channelLots of you have been asking me to talk more about APR or annual percentage rate.

The same goes for saving on which you earn interest. APR or annual percentage rate is the interest rate you pay on a loansuch as a credit card or auto loanon a yearly basis. The percentage part of APR is the amount of interest that you pay on the sum that you have borrowed on your credit card.

Your credit card probably lists an annual interest rate an A. That means you have 1000 less 400 or 600 in available credit. Lets use as an example an APR of 199 which is fairly standard for people without stellar credit -- who ironically are the most likely to need a credit card to plug day-to-day holes in their budgets.

Credit cards are accepted at more places than charge cards and prepaid cards. The Annual Percentage Rate APR is designed to be a benchmark for consumers providing an annual summary of the cost of credit. APR is an annualized representation of your interest rate.

APR stands for Annual Percentage Rate. If the steps above seem confusing heres an example of how to calculate APR charge on a credit card. Imagine you charged 1000 in new furniture on a credit card with a 20 percent APR.

In simple terms its the cost of borrowing the money. Do a comparison of credit cards fees rates APRs and balance calculation methods before you accept even a preapproved credit card. Here are a few important terms you should know when looking for a credit card.

The federal Truth in Lending Act makes it easy to compare credit card offers because it requires credit card companies to provide written information about the credit card terms. Heres how it works. This is the cost of the credit expressed as an annual rate.

Because of that the smartest option is to avoid credit card interest entirely. Have you ever wondered how credit card interest works. How do they determine how much you owe.

As well as the interest the APR also takes into account any compulsory charges like an annual fee if there is one. Easy to carry easy to use. What is an interest rate.

The calculation includes any fees you may need to pay plus the interest rate a lender applies to your particular loan. Credit card APRs are usually high -- much higher than what youd find with a mortgage APR or auto loan APR. Annual percentage rate APR.

To calculate your cards APR multiply your Average Daily Periodic Rate ADPR for your card by 365. Lets say your card has a 1000 credit limit and you make a 400 purchase. In this case your daily APR would be approximately 00492.

You can use credit cards as a tool to unlock cash back and travel rewards or a credit card can be an expensive dead weight holding you back from financial success. It is worked out over the course of the year as opposed to each month. If your current balance is 500 for the entire month and your APR rate is 1799 you can find your daily periodic rate by dividing your current APR by 365.

Its helpful to consider two main things about how APR works. You need to be at least 18 to apply for a credit card. When you borrow money for anything from a mortgage to a credit card the amount you pay back is dictated by the interest rate plus any additional fees.

Understanding how interest rates work will help you prepare for any interest rates change. How do interest rates. Many loans last longer than one year.

This is because doing this allows you to compare the various different options that you have in a quick and easy way. Your ADPR should be printed on your monthly statement. Pros of credit cards.

It doesnt have to be. Pay close attention to a cards default APR the rate you end up paying if you make a payment late or pay some other creditor late you exceed your credit limit or your credit score drops below a certain amount. With some cards the minimum age is 21.

If your card is lost or stolen just call your bank and cancel it. So if that is described as 199 representative APR then 51 of people accepted have to get 199 APR but the other 49 could be offered a different rate likely to be higher. When deciding between credit cards APR can help you compare how expensive a transaction will be on each one.

All forms of loan credit card or mortgages must have their APR displayed to you when they advertise their products. Many people who have credit cards find APRs and how theyre calculated to be a complicated subject. But with many credit cards interest is compounded on a daily basis.

If the bank only charged credit card interest once per year youd pay about 200 in interest 1000 x 020 200 assuming there were no additional fees. Presented as a percentage APR is a calculation of the full amount you will pay for a loan over the course of one year. At this point you can spend only 600 more on your card before you hit your limit.

How does APR work. Using the daily balance method your card issuer would calculate your average daily balance and multiply it by your daily periodic rate your credit card APR. With credit cards the rate for purchases as opposed to balance transfers or cash withdrawals is used as the main rate to advertise the card.

Although the amount accumulates daily its typically expressed as an annualized percentage rate APR.

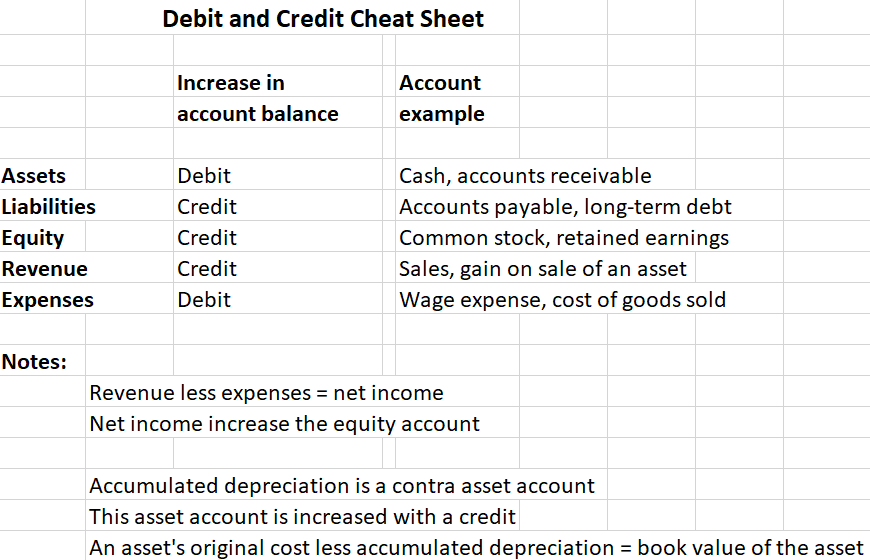

The purpose of my cheat sheet is to serve as an aid for those needing help in determining how to record the debits and credits for a transaction. The balance sheet is derived using the accounting equation.

Also some credits increase and some decrease.

Debit and credit cheat sheet. In this era of advanced technology large number of useful techniques and ways is accessible for easy and simple accounting and one of them is MS excel. The highlighted green on assets and expenses shows an increase in assets and expenses. Debit means to put an entry on the left side of the account.

What are debits and credits. In it I use the accounting equation which is also the format of the balance sheet to provide the reasoning why accountants credit revenue accounts and debit expense accounts. Most businesses these days use the double-entry method for their accounting.

What does that mean. This sheet will be help during the. Actually the cheat sheet users are mostly accounting students.

The Cheat Sheet for Debits and Credits by Linda Logan PartnerPresidentFounder of Fiscal Foundations LLC. Credit means to put an entry on the right side of the account. Accounting systems are valuable tools for gauging a companys fiscal health and charting its future growth.

However some debits increase and some debits decrease. But first you need to know. Hopefully this will give you a deeper understanding of the terms debit and credit which are central to the 500-year-old double-entry accounting and bookkeeping system.

Highlighted green on Liabilities Capital and income show a decrease. If you are learning the accounting system may be you needs a read and collect. Debits and Credits Memory Sheet.

Download the Cheat Sheet Effect on values in the debit or credit columns If a value is placed into the credit column of the assets account it will decrease the total value of that account. Think of these as individual buckets full of money representing each aspect of your company. These Journals are then summarized and the debit and credit balances are Posted transferred to the General Ledger Accounts and the amounts are posted to the left side of the.

Debits increase Asset accounts. Under this system your entire business is organized into individual accounts. The Balance Sheet Debits and Credits and Double-Entry Accounting.

Credits decrease Asset accounts. Asset accounts have debit balances. My Cheat Sheet Table begins by illustrating that source documents such as sales invoices and checks are analyzed and then recorded in Journals using debits and credits.

Debits decrease Liability Accounts. Liability accounts have credit balances. Most of companies use debit credit sheets to record financial deals or transactions of the company or business to record them in writing format.

It touches the lives of employees of businesses both large and small. All that remains to be entered is the name of the account to be debited. Debits dr record all of the money flowing into an account while credits cr record all of the money flowing out of an account.

It summarizes a companys assets liabilities and owners equity. Accounting Cheat Sheet to Credit and Debits Accounting is a system used in maintaining financial records for all types of businesses organizations and institutions. Shows how the five main bookkeeping accounts are affected by the debits and credits in the double-entry method of bookkeeping.

Debit and Credit Rules The rules governing the use of debits and credits are as follows. Every accounting transaction you see on your balance sheet and income statement must have at least one debit and one credit. The amount of the debit and credit is 300.

This sheet displays the accounting equation with a short description of each category. Entering them in the general journal format we have. Debits and credits are the true backbone of accounting as any transaction recorded in a ledger whether its hand-written or in your accounting software needs to have a debit entry and a.

Its why you will sometimes hear it referred to as double entry accounting. Debits and Credits Cheat Sheet. All accounts that normally contain a debit balance will increase in amount when a debit left column is added to them and reduced when a credit right column is added to them.

Our Debits and Credits cheat sheet below will help you to visualise the difference. If a value is placed into the debit column of the expenses account the total of that account will increase. Download Accounting Cheat Sheet and debit and credit lessons online for free of cost.

On the asset side of the balance sheet a debit increases the balance of an account while a credit decreases the balance of that account. Accounting Equation Memory Cheat Sheet. Credits increase Liability Accounts.

My cheat sheet should unscramble the confusion for you. Download Free Accounting Cheat Sheet and debit and credit lessons Accounting Play is now giving out free downloads to the users worldwide. When the company sells an item from its inventory account.

Since this was the payment on an account payable the debit should be Accounts Payable. A company will use a Balance Sheet to summarize its financial position at a given point in time. Benefits of use the debit and credit cheat sheet To study basic accounting double-entry.