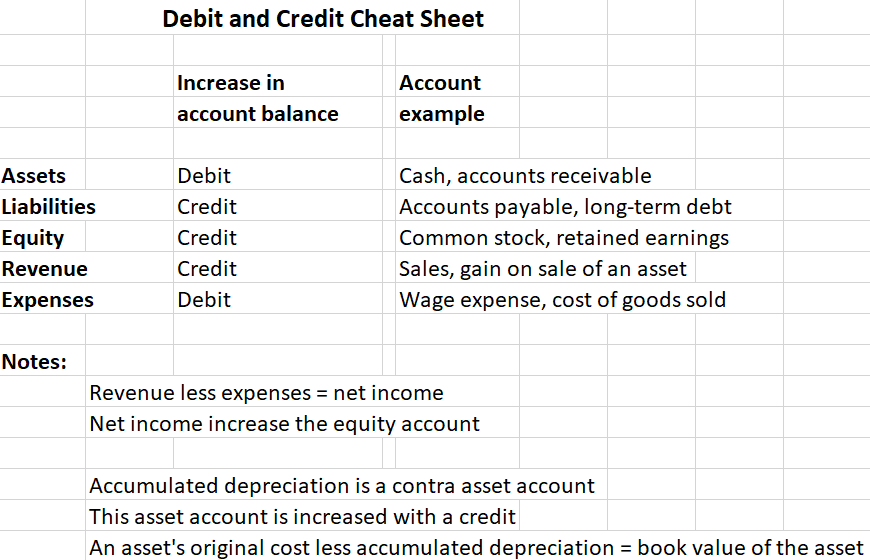

The purpose of my cheat sheet is to serve as an aid for those needing help in determining how to record the debits and credits for a transaction. The balance sheet is derived using the accounting equation.

Also some credits increase and some decrease.

Debit and credit cheat sheet. In this era of advanced technology large number of useful techniques and ways is accessible for easy and simple accounting and one of them is MS excel. The highlighted green on assets and expenses shows an increase in assets and expenses. Debit means to put an entry on the left side of the account.

What are debits and credits. In it I use the accounting equation which is also the format of the balance sheet to provide the reasoning why accountants credit revenue accounts and debit expense accounts. Most businesses these days use the double-entry method for their accounting.

What does that mean. This sheet will be help during the. Actually the cheat sheet users are mostly accounting students.

The Cheat Sheet for Debits and Credits by Linda Logan PartnerPresidentFounder of Fiscal Foundations LLC. Credit means to put an entry on the right side of the account. Accounting systems are valuable tools for gauging a companys fiscal health and charting its future growth.

However some debits increase and some debits decrease. But first you need to know. Hopefully this will give you a deeper understanding of the terms debit and credit which are central to the 500-year-old double-entry accounting and bookkeeping system.

Highlighted green on Liabilities Capital and income show a decrease. If you are learning the accounting system may be you needs a read and collect. Debits and Credits Memory Sheet.

Download the Cheat Sheet Effect on values in the debit or credit columns If a value is placed into the credit column of the assets account it will decrease the total value of that account. Think of these as individual buckets full of money representing each aspect of your company. These Journals are then summarized and the debit and credit balances are Posted transferred to the General Ledger Accounts and the amounts are posted to the left side of the.

Debits increase Asset accounts. Under this system your entire business is organized into individual accounts. The Balance Sheet Debits and Credits and Double-Entry Accounting.

Credits decrease Asset accounts. Asset accounts have debit balances. My Cheat Sheet Table begins by illustrating that source documents such as sales invoices and checks are analyzed and then recorded in Journals using debits and credits.

Debits decrease Liability Accounts. Liability accounts have credit balances. Most of companies use debit credit sheets to record financial deals or transactions of the company or business to record them in writing format.

It touches the lives of employees of businesses both large and small. All that remains to be entered is the name of the account to be debited. Debits dr record all of the money flowing into an account while credits cr record all of the money flowing out of an account.

It summarizes a companys assets liabilities and owners equity. Accounting Cheat Sheet to Credit and Debits Accounting is a system used in maintaining financial records for all types of businesses organizations and institutions. Shows how the five main bookkeeping accounts are affected by the debits and credits in the double-entry method of bookkeeping.

Debit and Credit Rules The rules governing the use of debits and credits are as follows. Every accounting transaction you see on your balance sheet and income statement must have at least one debit and one credit. The amount of the debit and credit is 300.

This sheet displays the accounting equation with a short description of each category. Entering them in the general journal format we have. Debits and credits are the true backbone of accounting as any transaction recorded in a ledger whether its hand-written or in your accounting software needs to have a debit entry and a.

Its why you will sometimes hear it referred to as double entry accounting. Debits and Credits Cheat Sheet. All accounts that normally contain a debit balance will increase in amount when a debit left column is added to them and reduced when a credit right column is added to them.

Our Debits and Credits cheat sheet below will help you to visualise the difference. If a value is placed into the debit column of the expenses account the total of that account will increase. Download Accounting Cheat Sheet and debit and credit lessons online for free of cost.

On the asset side of the balance sheet a debit increases the balance of an account while a credit decreases the balance of that account. Accounting Equation Memory Cheat Sheet. Credits increase Liability Accounts.

My cheat sheet should unscramble the confusion for you. Download Free Accounting Cheat Sheet and debit and credit lessons Accounting Play is now giving out free downloads to the users worldwide. When the company sells an item from its inventory account.

Since this was the payment on an account payable the debit should be Accounts Payable. A company will use a Balance Sheet to summarize its financial position at a given point in time. Benefits of use the debit and credit cheat sheet To study basic accounting double-entry.

Accounting Ledger Accounting For Dummies Accounting Student Accounting Classes Bookkeeping Business

Debit And Credit Cheat Sheet Chart Of Debits And Credits Accounting Basics Bookkeeping Business Financial Accounting

Https Accountingplay Com Binder

Debits And Credits Normal Balances Permanent Temporary Accounts Accountingcoach